Prediction markets function best when liquidity is high, but they break completely if the liquidity exceeds the price of influencing the outcome. Prediction markets function only in situations where outcomes are expensive to influence.

There are a ton of fun examples of this failing:

Option expiries (I don’t have a good single link for this)

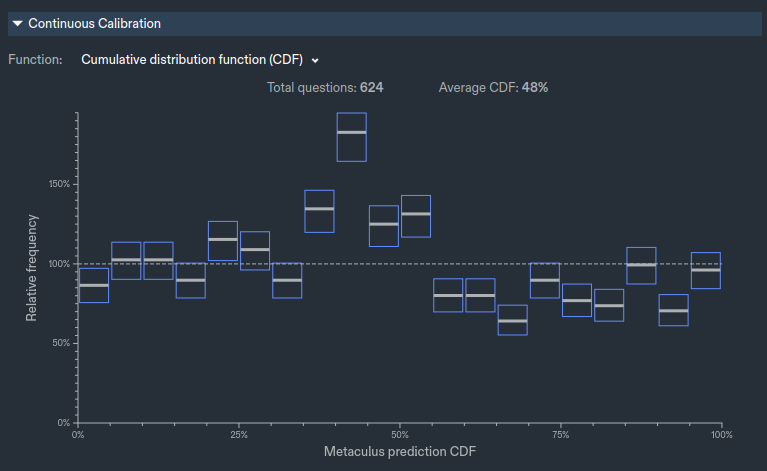

There are a bunch of different metrics which you could look at on a prediction market / prediction platform to gauge how “uncertain” the forecast is:

Volatility—if the forecast is moving around quite a bit, there are two reasons:

Lots of new information arriving and people updating efficiently

There is little conviction around “fair value” so traders can move the price with little capital

Liquidity—if the market is 49.9 / 50.1 in millions of dollars, then you can be fairly confident that 50% is the “right” price. If the market is 40 / 60 with $1 on the bid and $0.50 on the offer, I probably wouldn’t be confident the probability lies between 40 and 60, let along “50% is the right number”. (The equivalent on prediction platforms might be number of forecasters, although CharlesD has done some research on this which suggests there’s little addition value being added by large numbers of forecasters)

“Spread of forecasts”—on Metaculus (for example) you can see a distribution of people’s forecasts. If everyone is tightly clustered around 50% that (usually) gives me more confidence that 50% is the right number than if they are widely spread out