These are the things that I couldn’t fit into a Covid post even in the Not Covid section, but which aren’t big enough to deserve their own spin-off posts, and which are not time-sensitive.

With Covid winding down, I had the opportunity to work though some of that backlog this week. Rather than have a huge Not Covid section I’ve moved those here to their own post.

This post was written before Russia invaded Ukraine. I was going to keep adding to it, but at this point I am unlikely to be in a place to do that soon, so instead I’m posting what I have.

This also gives me a chance to see which ones do deserve their own posts, and spin those off. An experiment.

#1: Downtown In Trouble (WaPo)

Megan McArdle argues that downtowns are in deep trouble. Thanks to remote work, the argument goes, they may be missing a quarter of their people, and no one is facing up to this. What about the resulting lower rents?

Lower rents can ease the pinch, and in many areas they’ve already become more flexible. But Joseph Gyourko, a real estate professor at the University of Pennsylvania’s Wharton School, notes that only helps so much. If a significant number of the workers are gone on any given day, “You just don’t need as many Starbucks, or haircut places,” he told me, and “those folks are going to disappear. Some of these buildings, non-office buildings, will become empty. We won’t need as many.”

Converting offices to housing? In San Francisco or New York sure if there is no better option, but in general not economical.

Places like SF and NYC are not the problem here. There was a lot more demand for those downtowns than there was supply. If a quarter of current workers drop out to do remote work, there are plenty of others willing to take their place. For now there are empty offices because people are waiting for conditions to change, both companies unwilling to give up or shrink office space and landlords who do not want to lock in lower rents. At equilibrium, the markets will clear, the offices will be almost as packed as ever, so the number of visitors will stay almost the same, although some companies will buy more office space per person at lower prices so there will be slightly fewer people. But rents should adjust to make that small decline not a major issue for retail or restaurants.

Even if total needs do decline, there’s no reason not to fill all the space with useful things. If utilization goes down a bit and rents adjust for that, that seems fine. There should also be more things willing to go to downtown that rely on people coming in (including from outside the city) in order to use them. For example in NYC, the old gaming store Neutral Ground was downtown and quite large, but went broke when it tried to rent in too expensive an area. It could make a comeback.

Thus, in places in plenty of demand the limiting factor is lack of construction and space, so if there was previously nothing to worry about there mostly still isn’t that much to worry about.

But where there was already worry, worry more.

“I worry about Upstate New York, the Midwest,” says Gyourko. Rents there are too low to justify residential conversions — so low that there’s also little room to cut them in hopes of luring new tenants.

Exactly. There is a limit how far commercial rent can fall, and those are places where residential conversions also aren’t good choices. A huge problem then potentially results when the market does not clear and buildings sit empty. These are largely places surviving by inertia. People already live there and are anchored there, but long term few move there, many of the most ambitious move away and the economics keep getting worse even with cheap rents.

There are three potential solutions I could think of.

The first solution is that if you have a bunch of cheap housing and cheap business rents, and a lot of work is remote, shouldn’t that allow one to make something happen? I find it super valuable to live here in New York City, but others do not need that and have less ability to pay the housing costs. I ran the experiment living in Warwick, New York, and while I had less fun the economics were quite great and mostly everything was fine except for not knowing anyone and not meeting people because of the pandemic. It makes sense to consider relocating to such places if they get super cheap, either as a business (where the cool kids can choose to do remote work and the not-cool kids can have an office and very low rent) or as an individual that remotes in. It definitely feels like there’s something to be done here.

The second solution is to admit defeat, and build more housing in the places people want to live instead of trying to prop up places that no longer make economic sense.

The third solution is immigration. There are tons of high-skill people who would happily live in such places and cause the relevant markets to clear, while making everyone involved better off, and we don’t allow them to do this. Perhaps we should reconsider this policy.

#2: Noah Smith Interview with Ryan Peterson

Previously: An Unexpected Victory: Container Stacking at the Port of Long Beach

Ryan offers additional color on what happened with the tweetstorm and the port specifically and the problems with the supply chain in general. He talks physical specifics, which is great.

On the tweetstorm in particular, he does not talk about how he amplified the message, but he does confirm it was not his first boat ride and he already knew what he was going to find, although the trip doubled as a chance to pick another passenger’s brain. And also that boat rides are cool, so why not take one? Smart thinking if you like boat rides, as many do.

The basic problems in Ryan’s mind are:

Americans have more money.

Americans can buy less useful services.

Therefore, Americans want a lot more goods.

The supply chain is not set up to scale rapidly enough, insufficient slack.

This is partly just-in-time logistics, due to demand for Return on Equity (ROE).

With high ROE demand we removed all our ‘shock absorbers’ from the system.

Part of this is a huge systematic underinvestment in the ports over 20+ years.

We can’t even physically dock the largest ships even at our biggest ports.

We underinvest in the ports in part because they are owned by cities.

A city with a port realizes only a small portion of the gains from a well-run port.

There are lots of hard coordination problems and sub-optimal systems.

Federal government has a role to play to help and isn’t doing it.

We need better tracking and information flow. Current info systems suck.

Self-driving trucks, tunnels and hyperloops would be highly useful.

He says his company, Flexport, solves (some of) this.

He downplays the extent to which this is civilizational inadequacy at work and we are no longer capable of taking bold action to solve physical problems like inefficient, insufficient and obsolete ports, or even replacing terrible information tracking systems. It’s definitely there though, if you’re listening.

The basic story is that:

We’ve been muddling through with a barely adequate system for a long time.

No one cares enough to get the ports or other systems upgraded.

Everyone was forced to maximize share prices so no one built in any slack.

When Covid hit, supply went down but mostly demand went up a lot.

Our systems could not handle the demand.

We didn’t do much to fix this and since it’s all temporary, we mostly can’t.

I’m slipping in that last part, because Ryan does not discuss the question of whether or not there should have been disruptions, or how many and how big.

Our ports should be in better condition, or systems should work better in many ways, and we should have taken various logistical steps to mitigate the issues we saw. That much seems obvious.

Yet there’s also a strange sense of entitlement that seems implied in these situations and discussions, as well as those about inflation. There is this idea that we should be able to handle large unexpected surges in demand, that prices should not adjust too much, delays shouldn’t be too bad and everyone should still be able to get the new basket of goods they want at the old prices, then in 2023 go back to the old baskets. And that our failure to provide this shows something terribly wrong. We didn’t collectively invest enough in the necessary slack and flexibility.

Ryan calls what happened a ‘hundred-year storm.’ I notice that hundred-year storms seem to happen quite a lot more than every hundred-years. There have also been a lot of ‘perfect storms’ as when an Odd Lots show referenced a ‘perfect storm’ impacting the price of nails and Joe Wiesenthal noted how many other such storms seemed to be out there. Maybe our standards are off a bit.

Let us take the claim at roughly face value, and presume that the Covid-19 pandemic was a level of supply chain disruption one expects once a century. How much should one prepare for such a contingency? How much should that change one’s thinking?

As a private corporation, rather than slam the focus on “return on equity” I would argue that the levels of disruption we have seen seem entirely appropriate given a situation where:

Surge in demand is likely temporary.

Logistical problems are likely temporary.

People hate when you raise prices and will hate you for it forever.

What are you supposed to do? How much extra money could they have made by making themselves more robust to the situation?

We might be sad that we are seeing large surges in prices, but that is how one allocates scarce resources, especially with all the extra money that got printed. If anything the prices have adjusted too little, as people are not making enough hard choices to postpone consumption and engage in intertemporal substitution, and we know this because prices are being held back due to fear of pissing off customers.

We might be sad we see seeing large delays, but that is what happens when you can’t raise prices enough.

There would, in a world in which prices were adjusting correctly, not only be a team transitory that thinks inflation won’t permanently be high, but a ‘team temporary’ that thinks the inflation we did see will partly reverse itself because it is measuring high prices that are being used to allocate goods for which we have a temporary shortage such as cars. Some effect would remain from the extra money printed, but only some.

Anyway, the practical question is if this is the state of our supply chain, what are the levers we might usefully pull?

There are places where one could profit by providing better coordination or information flow, because current offerings are rather pitiful. That seems like something one could do in private business, and this seems like a lot of what Ryan and Flexport are centrally trying to do. It could be combined with doing actual shipping, or not combined.

There are some low-hanging-fruit marginal changes that make things flow better. Since everything depends on everything else and there are bottlenecks in a lot of places, and problems can compound, improving the right bottleneck (like empty container storage, if that happens to be the important one at a given time) can be big. This is what the Tweetstorm was about.

One could attempt bigger changes to upgrade our infrastructure at our ports, with our land transport or otherwise. This is tougher. Ryan seems right that the first step is making sure someone has the authority and responsibility to look into such things (which also helps with #2). Mostly this seems like it involves a general pivot into the Doing of Things in general.

If one thinks that slack is being undersupplied going forward one could attempt to use that as a competitive advantage, but maze levels (note to self: need an explainer link for the future) are likely too high for this as no one will appreciate what you are offering, neither customers nor investors. So you’d need to be able to sustain this for a very long time despite being actively punished for it, which means a full alternative stack.

Other cultural shifts that could help would include raising the status (or even better the actual conditions in ways they care about rather than ways you think they should care) of those who do the jobs that reinforce the supply chain including truckers, and of gaining more acceptance for using temporary higher prices to clear markets rather than delays or reduced quality. The big one, again, would be to value Doing Things more than stopping people from doing things, in various ways.

#3: Thread on Thefts Off Trains Leaving Los Angeles

When I first saw the photos of the train tracks surrounded by stolen packages, it definitely did not look great but did not give an idea of the scale of the problem.

Yes, obviously there was at minimum a huge litter cleanup problem. The boxes and junk are not being removed from the tracks. If these were the same packages sitting there for weeks or months on end, that is an eyesore and should be dealt with, but is not a ‘threat to national supply chain’ or ‘end of the rule of law’ sized problem.

This thread offered important context.

Union Pacific hires its own officers who are authorized to patrol, protect and arrest along the train line. This does not seem like it should be necessary but seems fundamentally fine. The train line introduces risk of theft, how it operates changes that risk, and the costs involved in that are being internalized. They claim they are making a bunch of arrests and deterring a bunch of theft.

The numbers indicate it is not working. Thefts are way up, 350%+ in October 2021 versus October 2020, with 90 containers compromised per day.

What’s wrong? According to the letter Union Pacific sent, they have yet to be contacted for a single court proceeding after over 100 arrests.

It has gotten so bad that UPS and FedEx are looking to route their packages around Los Angeles, and UP itself is seriously considering changing its operations to avoid Los Angeles County.

The LA County DA responds that UP is not sufficiently securing its trains and cut back on its staffing, less cases are being brought to the DA than in the past, and that other train lines are not experiencing similar problems.

A large portion of the comments responding to the thread were some version of ‘blame capitalism’ or ‘blame poverty’ or ‘oh poor Amazon’ for literal robbing of trains shipping stuff to regular people. This is indicative of why we have this problem.

That is what happens when the basic law of ‘don’t take other people’s stuff,’ second only to ‘no spill blood,’ is not enforced.

To what extent is this Union Pacific failing to do the legwork and secure its trains, versus the failure of Los Angeles to prosecute? Hard to tell. Curious if we can figure out the mix at work here.

#4: Tyler Cowen Claims Wokeness Has Peaked (Bloomberg / MR Summary)

The model Tyler is using here is confusing to me. Part of that is whether he’s actually pointing at Wokeness or if he’s pointing out some sort of generic left-wing prescriptivism since it prominently includes mask mandates. I agree there is a large correlation there, and for obvious reasons, but it still seems distinct to me.

The post also seems to confuse rates versus levels. The school board elections in San Francisco and the events in Virginia and the failure to fully cancel Joe Rogan (although he was forced to apologize and had a number of his past broadcasts censored) all point to the current level of the power of wokeness not being as high as some might have feared or hoped. That seems clear.

What it does not establish is the rate, which is what would determine whether something has or has not peaked. Are these fights that one would have expected different results from in the past in a way we could attribute to a ‘decline in wokeness’?

I think the answer is no. If there was the ability previously to cancel Rogan they would have done so earlier, as the attacks that landed were not based on new material but rather an assembly of old material. One could argue no one tried, but given Rogan’s importance that seems like an odd defense. And no one with Rogan’s importance, to my knowledge, has been successfully hit by this level of cancellation for offenses in this reference class.

Events in Virginia were a swing of a few points relative to what one would expect from partisan lean given the political leanings in general. As Tyler has noted in the past, many ideas the woke treat as the only acceptable viewpoint have always been in the minority. Sometimes they become majority views in the future, but nothing about Virginia seems like signs of an obvious decline rather than (mostly rather weak) evidence about the current levels.

Even if we did say we are seeing a short-term rise in some forms of backlash, that does not seem to impact the long-term trajectory of woke. Tyler agrees that woke will continue to gain in power in academia, will continue to dominate HR departments and so on, and that the young are more woke than the old. I notice I am confused why some amount of political pushback in response to those who take things too far or are seen as out of touch would alter the trajectories.

Perhaps the implicit model is that wokeness is a bandwagon. People join the woke team in large part because they think wokeness is gaining in status and power, and because they fear the power of the woke. Fear of being ‘on the wrong side of history’ and being retroactively attacked for even at-the-time acceptable views causes a race to get ahead of the curve, both within and outside the movement. No one knows what might set such folks off, so preemptive caution grows, and seeing that is self-reinforcing, and so on. So in this model Tyler’s post that wokeness has peaked is part of the mechanism by which it peaks – people notice it has peaked and are less afraid and less willing to go along with requests that seem crazy, and that too is self-reinforcing, especially as the woke in this story grow increasingly ‘out of touch’ and launch fights they cannot win.

The model could also be that wokeness has become self-limiting, and this is a sign that it has gone far enough that it has been the victim of evaporative self-cooling, doubling down on parts of the agenda that others are unwilling to accept, and sufficiently important to others that they are causing backlash. If the penalty for lateness is death, and increasingly more and more of the things one might do in life are defined as being late, eventually a rebellion will result. In addition, enforcement of such rules can only go after so many people at once. Being able to attack not only norm breakers but those who support, associate or even refuse to sufficiently loudly condemn norm breakers depends on norms remaining mostly enforced. So the more people defy such demands, the lower the cost to defy demands, until such demands become unenforceable and the whole thing collapses.

In this model, these failures to enforce norms will then snowball, thus the imposition of the type of norms in question likely has peaked.

I also worry that Tyler is noticing a local peak in Democratic party popularity and mistaking it for something else, when the median voter theorem and dialectic will presumably be hard at work and cause things to continue to swing back and forth.

From what I have seen, most of the anti-woke people I know do not share the view that wokeness has peaked. They expect wokeness to continue to grow in power for some time. The woke people I know are often raising alarm bells about how terrible particular things are, and how things are going backwards and everything is dystopian hell, but mostly I think they too continue to expect to make advances. The arguments for this seem strong.

Another argument is that Canada seems to be taking away freedom to transact from those who are expressing anti-Narrative viewpoints too loudly or in unapproved ways, and setting up the infrastructure to do this to people more broadly. This has many implications for how such dynamics might play out in the future and elsewhere.

Yet my personal felt and lived experience is that the presence of ‘paradox spirits’ of wokeness peaked in the summer of 2020. Before then, I felt increasing danger that I might say the wrong thing. Since then, I have felt steadily decreasing danger. Part of that is writing constantly that gives me feedback and data on where there is and is not such danger, and getting more experience and confidence, so there’s a simple alternative hypothesis to explain why things seem this way. My hunch is that a lot of this is the result of the pandemic, where ‘experts’ made far too many attempts to stifle obviously true things that had major direct physical impacts on our lives and also kept changing their stories and being rank hypocrites and talking obvious nonsense, and forced us all to re-engage much more with the physical world and have less tolerance for the theater of the absurd.

I give Tyler a better chance of being correct here than I expect most people I know to give him of being correct, but mostly not for the stated reasons. Also not sure where Ukraine fits into this.

Links In Brief

This is more like a normal but lengthy Not Covid section.

#6: Small Notes on Ukraine

Mostly I’m not covering the Ukraine situation due to my ignorance but I will share that Putin convened a meeting of his security council to debate whether to sign documents… that he had already signed two hours ago. Quite the demonstration. My current model, although without proof and without high confidence, is that Putin is intentionally choosing non-sensical and transparently false justifications to make it clear he does not believe he needs justification to do this.

Also, if you were ever wondering what the Virtuals vs. Physicals divide looked like in its Platonic form, we have a winner.

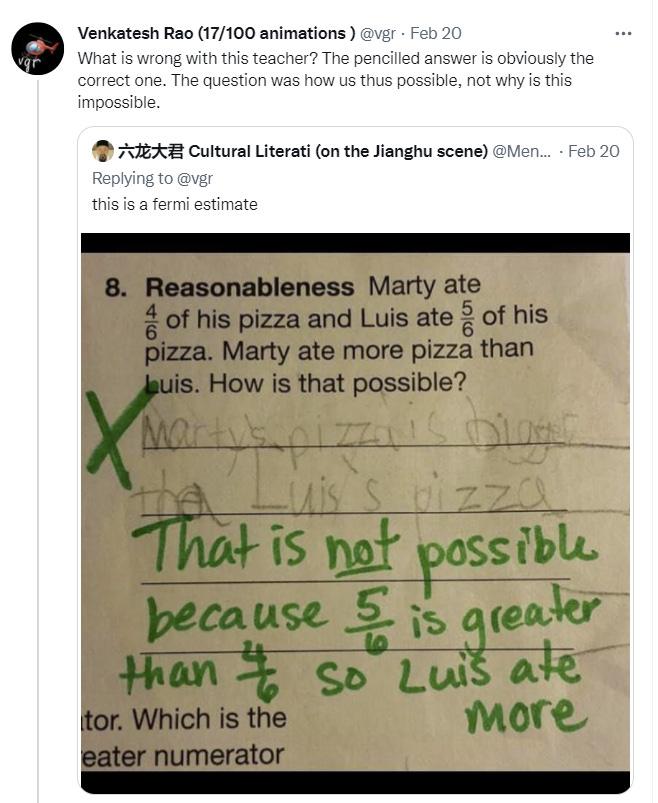

#7: Pizza Party

As I replied on Twitter, the real test is what the student does next.

There are so many levels of profound wrongness at play here. I can certainly imagine someone not realizing that pizzas come in different sizes, but the student points this out explicitly. I can imagine, having not thought about different sized pizzas, concluding Luis must have eaten more pizza, but that would also requires directly contradicting the question.

There is no non-motivated way to make this error. Also notice that Rao’s objection leans more centrally on the second problem, that there is another authority telling you there exists a solution, rather than on the part where the kid’s answer is obviously correct.

The thread continues.

What’s funny is Rao essentially makes the exact same mistake and assumes that Luis and Marty are eating too much pizza. Whereas we know that Luis had a smaller pizza, so it is very far from clear that Luis had an unusually large amount of pizza. For all we know he ate one of those little ones you heat up in a toaster and didn’t even finish it.

I agree with Rao that teachers are unusually smart on average, simply not sufficiently unusually smart that our educational system successfully allows them to learn how to add two single-digit fractions.

#8: Shop Around

Bryan Caplan says that our failure to shop around and bargain causes us to pay full price for major purchases, and that this causes us to miss out on big savings. What’s up with that? A lot of this is people really, really, really hate mild social awkwardness, and the potential to save a bunch of money often is not enough to compensate for that, slash they are adaptation executors and not fitness or profit maximizing. Yes, ‘ask for a discount’ works great, but people by default still mostly won’t do it. I do encourage you to do it more. Shopping around is also often valuable and can be less awkward, but requires a bunch of annoying work. There are others where ‘do a bunch of filling out of paperwork and demonstrating you are willing to do that’ gets you paid, because it shows you are a customer who cares about savings and also are worth pursuing because this makes you unlikely to default.

Where I would challenge Bryan is on the idea that credit cards don’t need to charge 18% interest in general, or that real estate agents aren’t often worth 6%. For the credit cards, a lot of people do default and there are various costs to absorb. I don’t think the credit card market is highly uncompetitive. Quite the opposite. I think that a low interest rate is a perk that is desired mainly by two groups. One is at high risk of default, and they want to do this to string balances along, and they’re bad customers. The other are the people gaming the system for perks, and mostly you don’t want them either. What you want are the customers who want to use your cards to earn ‘reward points’ and cash back, they pay their bills and you make your money on the fees and occasional chance to charge them a big interest rate when they mess up.

For real estate agents, I think Bryan is not understanding the marginal value provided here. Real estate markets are not efficient. It is not that it costs $60k to sell a million dollar home, it is that the difference in chance of selling and expected price between an expert and not an expert is quite large, and the $60k is typically split between the two agents. To the extent that these markets are efficient, it is because they are pricing in a ton of non-obvious stuff.

As a buyer, our real estate agent stopped us from bidding on multiple places that would have been major life mistakes to buy, found us a large number of candidate places and dismissed many others without our having to see them, explained why and how she was doing all this and why we should consider valuing various things, and finally helped us figure out what the right place was when we saw it and then move quickly enough to put in the right bid and get it. Then she walked us through various other stuff we needed to do to finish the deal, and how to guard against various forms of fraud and a bunch of other stuff I’m sure I am forgetting. It was a ton of high-skilled work and required a lot of hard-won experience. Yes, it was a big commission, but a lot of that stuff is super valuable.

Certainly in a situation like the one that now exists in many places, where houses will get dozens of bids within a day or two and go well over asking price, the difference between taking profit maximizing actions and not doing so could easily well exceed 6%.

The question to me is not why the price and overall transaction costs are on average this high. The question is why the price is standardized. Quality, including being aligned with you rather than trying to maximize commissions per hour, matters a ton here and is well worth even more, whereas a shoddy agent is worth a lot less. Yet as I understand it prices are mostly standard, except for a few discount agents who do very little.

#9: Miscellaneous

I wonder if anything will come of Paul Graham finally realizing this consciously.

Older but good thread from 25 January summarizing the pre-K findings that have come out recently, drawing the obvious conclusion that it is bad to let subsidized pre-K crowd out other child care and so we should help parents by giving them money.

MIT completely dominated the Putnam competition. My experience with the Putnam was that the one year I took it, the prep sessions started out with about ten students and by the end I was the only one attending. Then I didn’t get my test back, same as I didn’t get the USAMO back, and I lost interest. The skill and dedication payoff curves in such things are enormous, and they almost seem designed to drive all but the most determined away to save on having to grade answers. But man, this is ludicrous. If you’re reading this and have the opportunity to go to MIT, maybe found a business instead but if you’re going at all it seems crazy to go to any other college. Makes me sad I didn’t spend one of my seven allowed applications trying even though statistically speaking I was about (checks notes) 0.00% to get in.

Beware trivial inconveniences, moving and architecture editions. Making these things easier would be quite the big game.

Especially given that this is causing labor markets to not clear or, in a much more troubling frame, not even fully exist.

Andrew Yang points out that only 40.5% of collage students are men and young men have a bunch of other problems as well that essentially no one is talking about. There’s a bunch of stuff going on with young people that seems deeply out of balance and screwed up, of which I have little understanding.

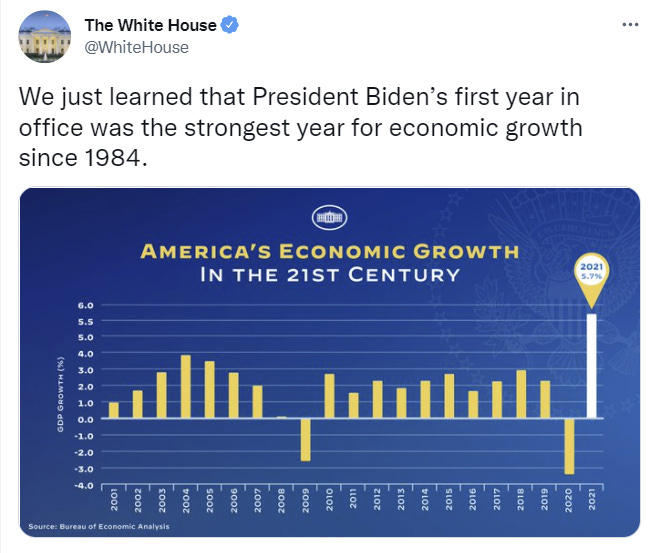

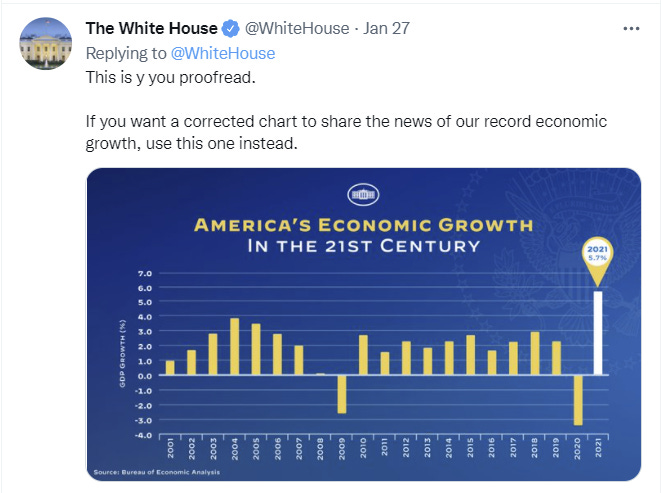

Was a few weeks ago but remember that time The White House put this out?

Where they added 5.5 to the Y-axis which made the bar on the right look bigger?

The part I just realized was the response they put out.

Proofread. Yeah. So we’re going with mistake. I’m very curious how that happened.

Guess who also totally killed himself while not on suicide watch.

Jean-Luc Brunel: Jeffrey Epstein-linked fashion agent found dead in cell

Detained associate of late billionaire faced charge of underage rape

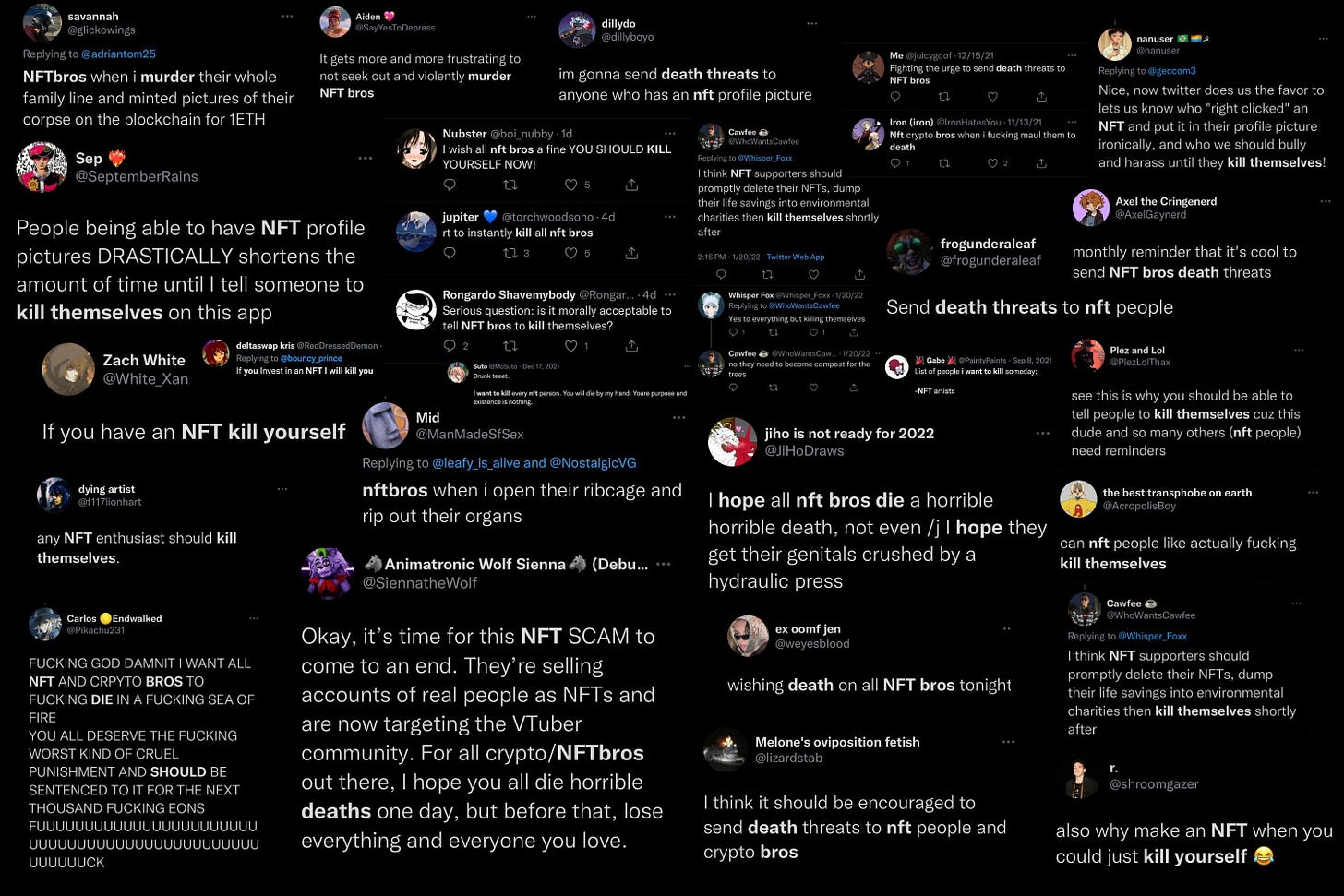

On top of doxing those who donated money to support what they at least thought was a protest, there’s also been media efforts to dox the founders of the bored ape yacht club. I do understand they are wanted in several jurisdictions for poor taste, but maybe their desire for anonymity is more about the death threats around NFTs.

I happen to think such things hold great promise as game pieces and enable the creation of things people value, especially when they are put on blockchains like Tezos that don’t have to burn lots of energy and therefore carbon. Others have made their own feelings clear.

This is niche so not for everyone, but fascinating for those who are interested in such dynamics: Jorbs goes deep into the history of competitive Slay the Spire.

It is odd the extent to which money can’t easily be exchanged for even highly normal services.

It would be one thing if the only way to get the best people would be to know people who knew them, but needing to use networks to get anyone at all implies something bigger is amiss. Yet it seems like this is exactly the situation where, yes, Capitalism Fixes This and the problem is insufficient amounts of capitalism. A plumber who won’t come to your house in exchange for money is a sign that services are being distributed on some other basis. The super-generous version of this is that there are socially enforced price controls messing things up (e.g. you get punished for price discrimination so they can’t charge ‘top dollar’ to a new client) and thus service providers can’t be compensated for the uncertainty of a new client who might not treat them right.

Bryan Caplan tried to survey to see if there was a correlation between being a STEM person and supporting nuclear power, instead only learned that if you know to read Bryan Caplan you know to support nuclear power and also are probably a STEM person.

I do not know of an actual intelligent individual who opposes the construction of nuclear power plants or the widespread expansion of the use of nuclear power. Again, I need to write Policy Debates Should Appear One Sided.

Wordle, a simple five-letter-word six-guess one-word-per-day mastermind game, grew popular on Twitter then was bought by the New York Times. A thread here explains that no, The New York Times may have removed ‘offensive’ words like “slave” but did not make Wordle harder. I presume that having fewer words makes the game slightly easier. Which leads to a counter-thread saying that the recent words actually have been harder but it is likely the luck of the draw. I offer a third perspective, which is that Wordle at NYT actually is harder and the reason is because it is less fun now. Which makes it harder.

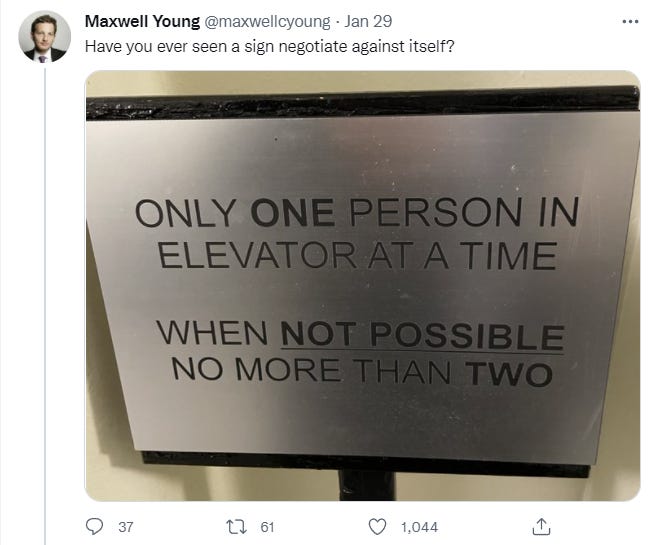

Don’t make me tap the sign. Or if you must, don’t make me tap it twice.

IRB is there to protect us from this cold, harsh world.

Reminder that aggressive individual trading tends to go quite badly. That does not mean one must confine oneself to index funds, I definitely do not do that and I think (although it is of course Not Investment Advice) that picking stocks to hold medium to long term is actively good for various reasons, but constantly buying and selling or hopping on trends tends to end badly even before tax issues. Also note the top result here, where is our ETF to short stocks being bought on Robinhood (seriously, what’s the ticker so I can buy some of it, I totally expect this to persist) and also the EMH keeps getting falsified.

Tenure is denied at MIT, it is discovered that decisions made in office meetings at large organization are the result of office politics and that those who care about getting ahead via office politics are using such considerations to make such decisions. Your model should not find any of these claims surprising. Merit is still a public good for the department, so the extent to which it still matters is a good way to track the local maze level.

What was the Tesla master plan and what does that tell us about start-up plans?

The question is to what extent the above was the real plan, either planned or realized, and to what extent the actual plan was:

Raise money.

Build sports car.

Use that car to raise more money including government aid.

Use that money to build a more affordable car.

Use that to raise more money including government aid.

Use that money to build an even more affordable car.

While doing above, be the world’s greatest Twitter troll to help raise the money.

Tesla is far more ‘real’ than most similar companies. Its success depends on its ability to create superior versions of important physical goods, including making real technological advancements, and on its ability to sell those high quality goods for premium prices. Electric cars are the real deal. Yet Elon Musk has been around long enough to know what steps his master plan was missing. He had to know the vision of a Tesla that grew using reinvested profits from selling its cars was only going to be a reality after a large number of growth cycles based on raising capital. Yet telling the story in the master plan was key to the raising of the funds.

An argument from Tyler Cowen that quarters are better than semesters and very short classes would be even better, because they would allow more exploration of professors and classes are too long anyway – that classes should be as short as possible but no shorter. This seems basically right to me if you are using the learning model of education rather than the signaling one, and basically wrong if one is using the signaling model. My other worry here is that forcing college students to finish things they no longer have intrinsic motivation to continue and that are not a good fit for their skills and interests, and especially that are sometimes over their heads and that force them to muddle through and guard against failure, may be one of the things college is testing and/or teaching, and removing longer commitments would damage this. I would also worry that giving easier outs would cause students to even more reliably choose easier classes and paths over harder ones and think even more in the short term, which would not be good either. Seems complicated and non-obvious.

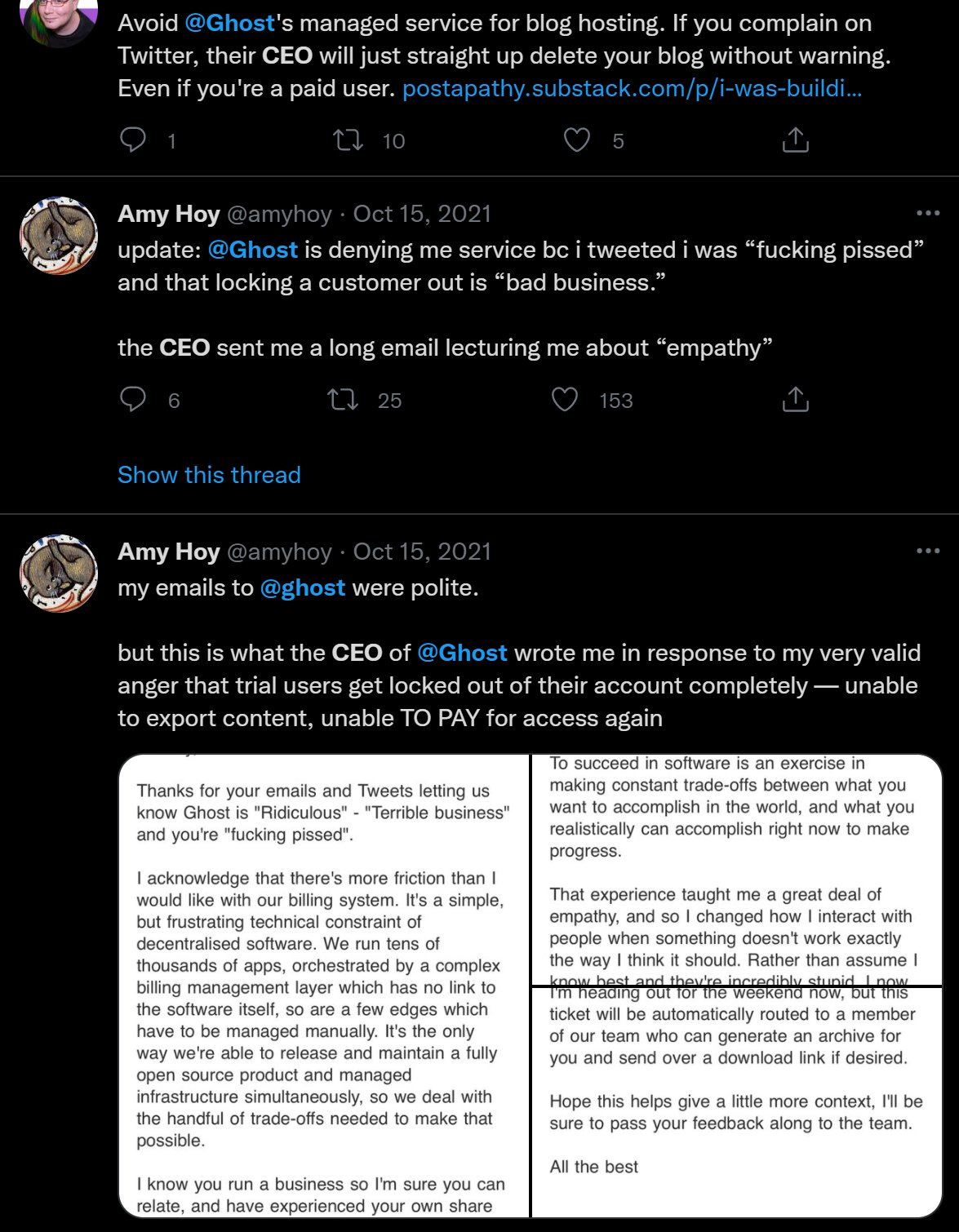

Founder of Twitter asks why not choose Ghost over Substack to get greater freedom.

Some people explained and clearly had much fun doing it.

The way I see it: Ghost gives you the option to self-host (as does WordPress), but most people are not interested in handling all of that. I am happy to have that option in case something happens but I can always migrate to such a place when and if such things happen, and also it’s not obvious the extent to which this was the point of censorship vulnerability in one’s technology stack. The serious comparison was hosting from Ghost versus hosting from Substack. The freedom issues in terms of censorship didn’t seem to then obviously run one way or the other, and the customization options mostly aren’t things I much value unless I get to do cool things that require hiring help to add features (for example, I’d love to add automatic links from certain key phrases and also automatic pop-up boxes with quick explanations when one hovers, especially for concepts unique to this blog).

Thus, it came down to other issues. Substack charges higher fees on earnings, gives you less ability to customize and provides you with less good analytics. So far its default SEO also seems quite bad, although I didn’t consider that at the time. In exchange, it has an editor I liked better, it makes for easier discovery and easier subscriptions especially paid subscriptions because people are already used to subscribing and have already given their payment information, and generally makes things smoother. The starting up experience is much better, they had someone who helped me with it and it was very easy to get things to a good state, also there was no charging money up front which maybe should not matter but totally does.

Bottom line came down to “Substack is a better shovel-ready product even though it may have less long-term upside, but if things get to the point where I can go in deeper then I can always migrate.”

Now that I have larger readership and more support, it’s starting to be more interesting to consider ways to get additional features that would enhance things further, and I’ll want to look into that over the coming year. I think I made the right decision, but conditions are changing.

Is Deontology Incompatible with Progress (as in Progress Studies)? That depends on what your deontological rules are, and especially what your rules are for how to change the rules over time. If one frames deontology as a focus on prohibitions and preventing bad things being more important than prescriptions and ensuring new good things, then yes, absolutely, you’re creating what Vitalik calls a vetocracy. Lots of veto points are an enemy of Progress. Also these are two masters, which means you cannot properly serve them both at once. If your deontology is oriented differently I do not see that serious of a conflict here. I also don’t see any conflict with virtue ethics. Utilitarianism tends to be the way people in favor of Progress think and how they justify their arguments, but the case for Progress in no way requires it. I continue to (in my totally-lacking-formal-anything-kind-of-way) view this all largely as ‘if you think your implementation details of [utilitarianism, deontology, virtue ethics] isn’t isomorphic to a valid implementation of either of the other two, your implementation is invalid’ so you can do anything with all three, it’s more that they each make different things easier to see and consider, and point us towards different foci and modes of thought. Things I’d love to explore more in tons of detail at some point.

Different approaches to gerrymandering: Democrats in New York get ambitious, Republicans in Texas guard against bad outcomes. It seems like not enough people are asking the question of what is more likely to tip control of Congress. The goal is not to maximize the number of seats, it is mostly to maximize the chance you have slightly more than half of them. So a gamble that kills you super hard when you would have lost the majority anyway seems strategically wise to me.

I’ve been reading and following Ozimek for a while. He’s remarkably good.

And of course, Zero Hedge predicted −250k.

So essentially the algorithm mostly did exactly what it is designed to do, which is to point customers towards products they are likely to want, except that in this case what they want to do is commit suicide. Which indeed does call for a manual override of the algorithm to have it offer such folks help instead, but I don’t see another way to prevent this from happening.

Remember that Alzheimer’s drug the FDA had no business approving but approved anyway? Looks like Medicare is refusing to cover it. Let’s see if we can make that a habit.

Marshmallow test study fails to replicate and finds nothing whatsoever, but in a small homogeneous sample of kids who almost all ended up completing college. I don’t see this as a contradiction so much as a hint of what the test is measuring. Part of me wants to categorize this as ‘failure to replicate this study will fail to replicate’ but I also agree the test likely is not measuring what they originally assumed it was measuring.

Looks like Robin Hanson should try out auctioning the topic of a future post?

Overwhelming support. Probably I should try this as well.

I had a little discussion of the realtor market here. Some relevant quotes:

Anyway, I think of the market for people hiring realtors as a bit like the market for boards hiring CEOs: Specifically, there’s a lot at stake, and there’s no good a priori way to ensure that you’re really getting a good person, but if you try to penny-pinch then you know for sure that you’re going to get someone crappy. So the equilibrium involves lots of tremendously-overpaid people who are not actually very good at their job, but good enough at self-promotion to get into the market.

Yes, it makes sense to do a higher marginal commission for the seller with the same expected payout (but that also makes things even trickier for the buyer).

I agree that there are a bunch of really bad agents out there that are getting overpaid.

I’ve been staring at the WH economic growth plot for minutes and am not seeing the issue—someone help me out?

Look at ALL the numbers on the y-axis—read the whole axis bottom to top.

Finally got it on like the 11th reading! Thanks

They put an additional value of 5.5 into the top half of the chart (see it on the left-hand side). The problem is they made it just as far away from 5 as 4 is, so it visually gives Biden’s numbers a whole extra percentile gain relative to the other years on the chart.

Edit: I see this was tackled in a reasonable timeframe, which is good, but I am straight baffled why I saw the 1-day old post with just Maxwell’s question, and didn’t see anything else until I posted this belated answer.

Might help someone else—good explanation—cheers!